Investment Process

How we work with you to help achieve your aspirations

Our Investment Process

Deciding how best to invest your money can be daunting. With so many options available and so many uncertainties, how do you choose what is right for you?

Our role is to eliminate as much of that uncertainly as possible and to work with you to identify the most appropriate way for you to achieve your financial goals.

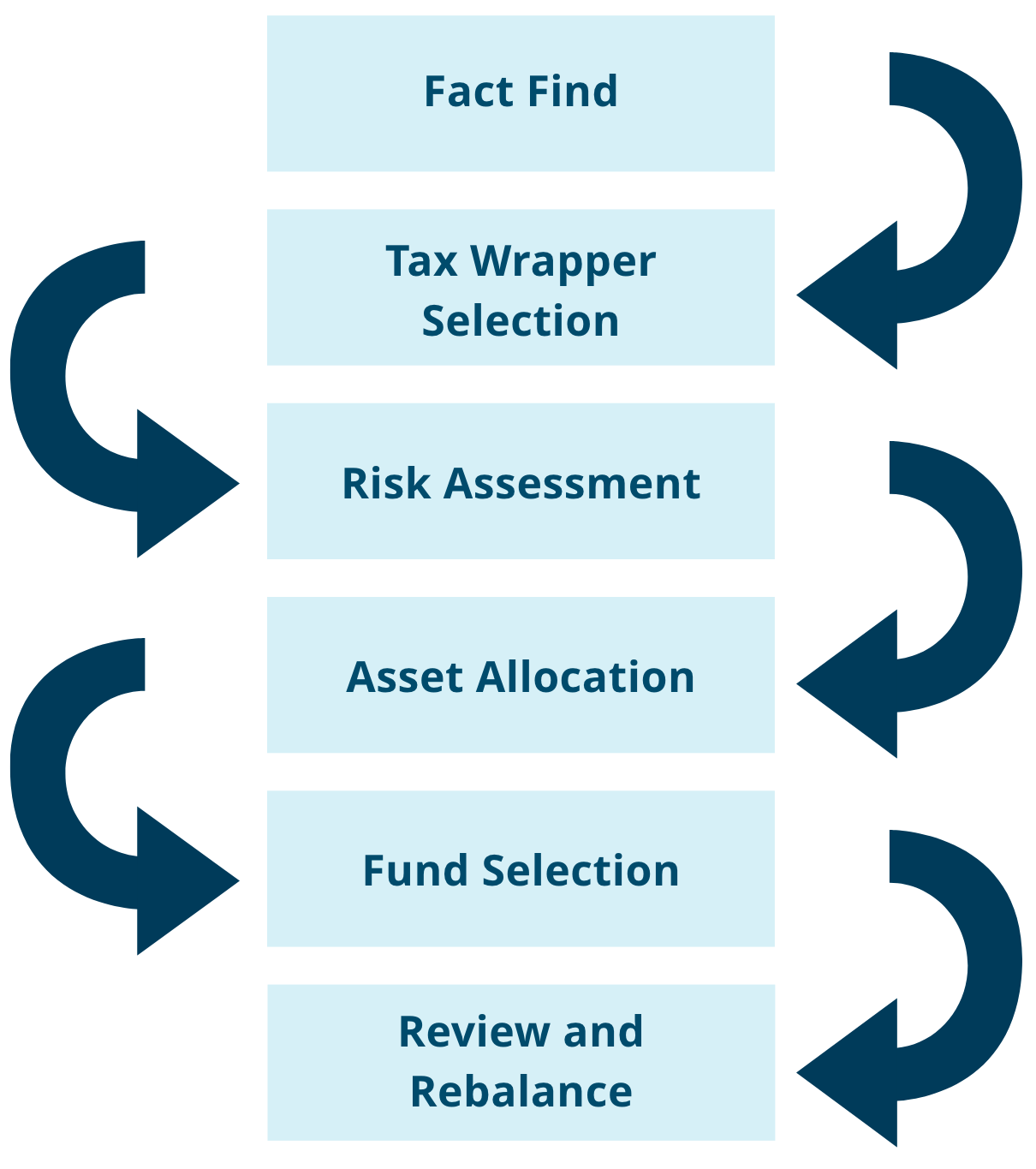

Our Investment Process is designed with that in mind. It creates a framework for us to discuss your needs and expectations, to assess and agree your attitude to risk and then to build and manage your investments with you in mind.

By working through a series of logical steps, you will gain a better understanding of the reasoning behind our recommendations and confidence in the resulting choice of investments.

This flowchart outlines the Investment Process and explains how we manage each stage of it with you.

Getting to know you

Our fact find will be wide-ranging and thorough to ensure of subsequent advice is soundly based. In addition to taking into account your personal and financial circumstances we will talk through tax planning, discussing opportunities where possible to improve your situation.

Ways to hold your investments

Once we have established your financial goals, we will then determine the appropriateness of tax wrapper(s) to meet your needs. One of our main deliverables is to help all of our clients invest tax efficiently and provide accurate and sound advice in tax advantageous products. In addition to pensions, ISA’s and bonds, we may look at alternative investments. Either way we will establish your tax planning needs and identify which investments to include.

Risk assessment

We ask all clients to complete a risk questionnaire and encourage them to reflect on their values and define the purpose for their money. We measure our clients’ investment expectations against their possible desired returns.

Asset allocation

Asset allocation involves getting the balance of assets in your portfolio right. Different types of assets have different performance characteristics, so our aim is to allocate the appropriate blend of funds to your portfolio, so that, over time, the peaks and troughs of their performance balance each other out in a way that is optimised for your risk profile and your expectations for growth.

Fund selection

With thousands of investment options to choose from and each of these trying to achieve different things, understanding the reasons for their relative success is where our knowledge and skills lie. This helps us appreciate how they may perform in the future and this in turn helps us identify opportunities for ‘outperformance’ – doing better than average and allocating them to you, our client.

Review and Rebalance

Our Investment committee meets monthly to assess the performance of our portfolios and their component funds, during this meeting we pay particular attention to outperformance and underperformance. We report our findings back to you on a quarterly basis and re-balance / make fund changes as required under the fund management status.

)

Moyes Investments is a trading name of Moyes Financial Planning Ltd. We are directly regulated by the Financial Conduct Authority. Our Financial Services number is 571590 and this can be verified by the online FCA Register – www.fca.org.uk/register

The Financial Ombudsman Service (FOS) is an agency for arbitrating on unresolved complaints between regulated firms and their clients. Further details can be found on www.financial-ombudsman.org.uk

The guidance and/or advice contained within the website is subject to the UK regulatory regime and is therefore primarily targeted at customers in the UK